Kesar India company linked to real estate will issue bonus shares, know record date

Shares of Kesar India, a company linked to the real estate business, are buzzing in the market these days. Shares of Kesar India touched 4,114 on Monday. Shares of the company hit a new 52-week high on Monday.

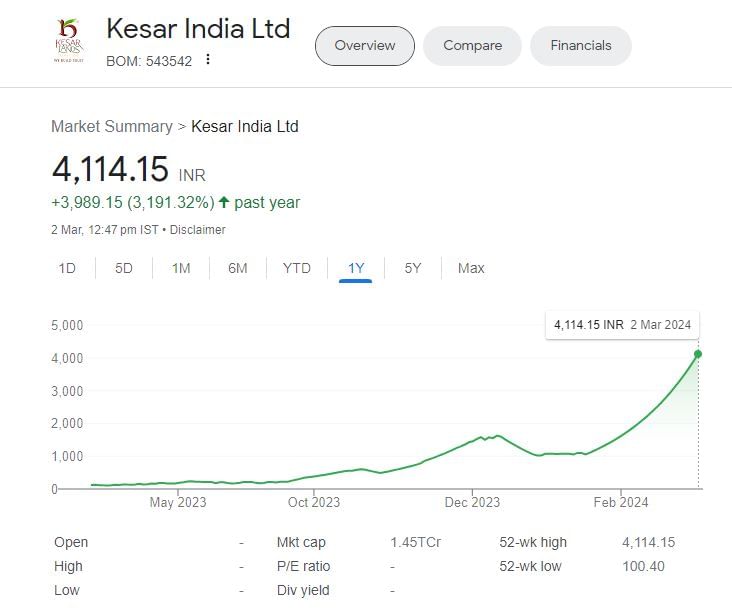

Shares of Kesar India, a company linked to the real estate business, are buzzing in the market these days. Shares of Kesar India touched 4,114 on Monday. Shares of the company hit a new 52-week high on Monday. Shares of Kesar India have gained more than 3191.32 in last one year. The company is now gearing up to give its investors a big gift. Kesar India will issue bonus shares to its investors.

Decision regarding bonus shares

Kesar India has stated in its exchange filing that the meeting of the board of directors of the company was held on 14 February 2024. The meeting considered and approved the results of the October-December quarter of the company, increase in the capitalized capital of the company and declaration of bonus shares. This is the first time that the company is going to gift bonus shares to its investors. Kesar India's market cap is around Rs 1.452 crore.

Shares gained 3191.32 percent in one year

Shares of Kesar India have seen a rapid rise in the last one year. On 4 March 2024, the shares of the company were Rs. is at 4114.15. Shares of Kesar India have gained 1957 percent in the last 6 months. Shares of Kesar India have increased by Rs 200 to Rs 4,114.15 during this period. The company's stock has seen an increase of 129 percent in the last one month. Shares of Kesar India have gained more than 15.69 percent in the last 5 days.

The company told SEBI that this is to inform you that as per SEBI's Regulation 42 Regulations, 2015, the company has decided, and for the purpose of ensuring that, Tuesday, March 19, 2024 has been fixed as the record date. Shareholders are entitled to issue bonus equity shares in the ratio of 6. 6 Equity Shares Rs. 10/- for every 1 (one) existing equity share of Rs. 10/- each, subject to the approval of the shareholders being acquired.

1_30.png)

1_30.png)